The database of taxpayers in Nigeria has increased from 20 million to 35 million, Mr Oseni Elamah, the Executive Secretary of the Joint Tax Board (JTB), has said.

According to him, the great feat was achieved as a result of the ongoing database consolidation of JTB, being carried out in collaboration with the Nigeria Inter Bank Settlement System (NIBSS).

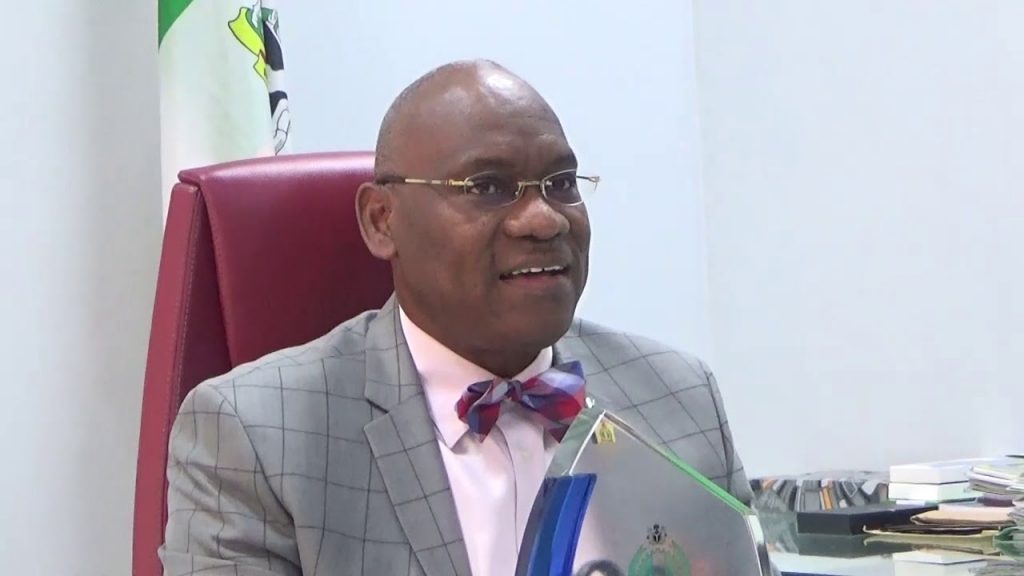

Mr Elamah, who made this known in an interview with the News Agency of Nigeria (NAN), on Sunday in Abuja, said the figure comprises both individuals and corporate bodies and has translated to increase in the actual money collected as tax.

“We are trying to break them into classes of taxpayers and various jurisdictions where they reside, state by state.

“Hopefully, this information will be communicated to all the states by first week of January and then we will ask them to file their reports for tax assessment. From the information, we will tell Nigerians: how many are teachers, artisans and entertainers, among others,” he said.

On the average, he stated that about 22 per cent growth in tax revenue had been recorded in both state revenue services and Federal Inland Revenue Service (FIRS) when compared to 2017.

He further stated that it would be one of the best figures ever posted by FIRS and most states as the figure was collated as at third quarter; and it would move to 30 per cent by the end of last quarter.

He stated that with the coming of the Tax Identification Number (TIN), and Bank Verification Number (BVN), the tax authorities were currently tackling incomes of taxpayers and making sure they paid their taxes as at when due.

He gave the assurance that the board would create more public awareness and increase in voluntary compliance and also enhance the capacity of workers to be tax professionals.

He also commended Mr Babatunde Fowler, the executive chairman of FIRS and the JTB, for his role in achieving the feat within a short time.