Akwa Ibom State joined eight other oil producing states in the country to share N45.36 billion as 13 per cent derivation fund in January 2019, National Bureau of Statistics, NBS, reported.

According to InfoGuide NIGERIA “Akwa Ibom produces 504,000 bpd; Delta-346,000 bpd; Rivers-344,000 bpd; Bayelsa-290,000 bpd; Ondo- 60,000 bpd, Lagos- 40,000 bpd, Edo- 33,000; Imo-17,000 bpd and Abia-11,000 bpd.”

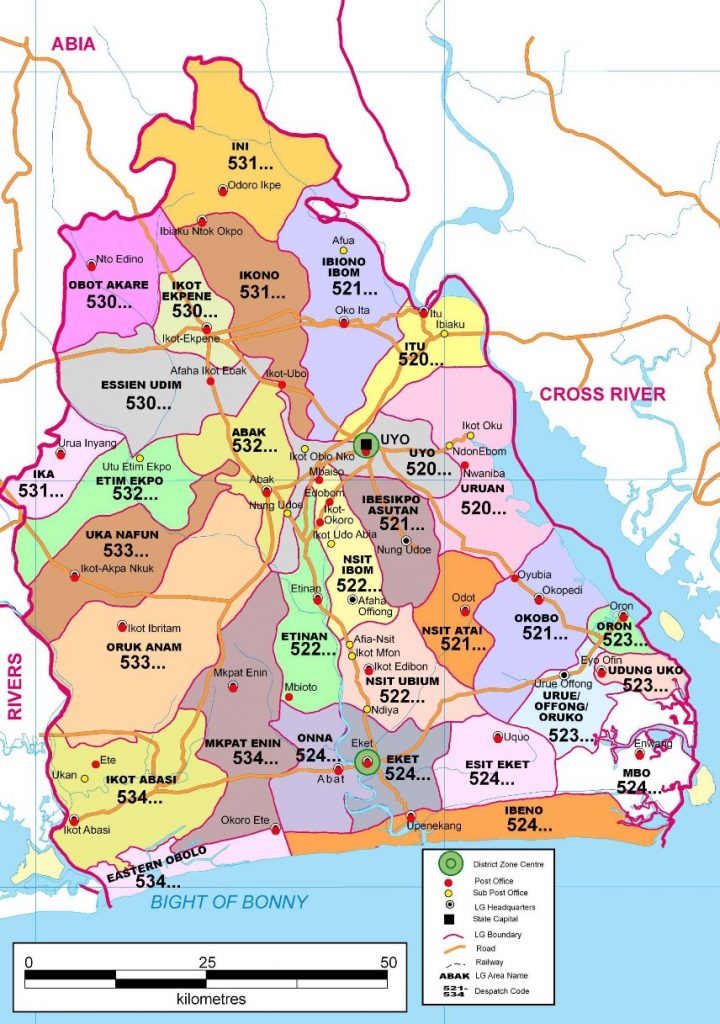

Oil wells in Cross River State were ceded to Akwa Ibom State during the ex-Governor Godswill Akpabio administration after a prolonged court case. This was after Federal Government had handed over Bakassi to Cameroon.

The NBS, which stated this in FAAC January 2019 Disbursement Statistics posted on its website, further said that N4.81 billion was disbursed as derivation and ecology and N2.43 billion as stabilisation fund to the benefiting states.

“The sum of N649.19 billion was disbursed to the three tiers of government in January 2019 from the revenue generated in December 2018,” it stated.

According to the bureau, the Federal Government got N270.17 billion, the states received N178.04 billion while local governments collected N133.83 billion from the Federation Account Allocation Committee (FAAC).

The report said that amount disbursed comprised N547.46 billion from the Statutory Account, N100.76 billion from Valued Added Tax (VAT) and N976.53 million exchange gain differences.

Revenue generating agencies such as Nigeria Customs Service (NCS), Federal Inland Revenue Service (FIRS) and Department of Petroleum Resources (DPR) received N4.69 billion, N4.04 billion and N8.04 billion respectively as cost of revenue collections.

Further breakdown of revenue allocation distribution to the Federal Government revealed that the sum of N216.57 billion was disbursed to the Federal Government consolidated revenue account.

In addition, the sum of N8.15 billion was shared for the development of natural resources and N5.82 billion to the Federal Capital Territory (FCT), Abuja.

The government financial system operates a structure where funds flow to the three systems of government from what is termed the Federation Account.

The FAAC serves as the central pocket through which the Governments – Federal, States, and Local Governments – fund developmental projects as well as maintain their respective workforce.

The flow of revenue into the Federation Account includes oil revenues and related taxes, revenues generated from the NCS trade facilitation activities, company income tax (CIT), any sale of national assets, surplus and dividends from States Owned Enterprises.

There are two components of the revenue allocation formula used for the disbursement of the Federation Account to the three tiers of government. These are Vertical Allocation Formula and Horizontal Allocation Formula.