Knocks and kudos have trailed the $3 billion loan facility obtained by the Nigerian National Petroleum Company Limited (NNPCL) from Afreximbank.

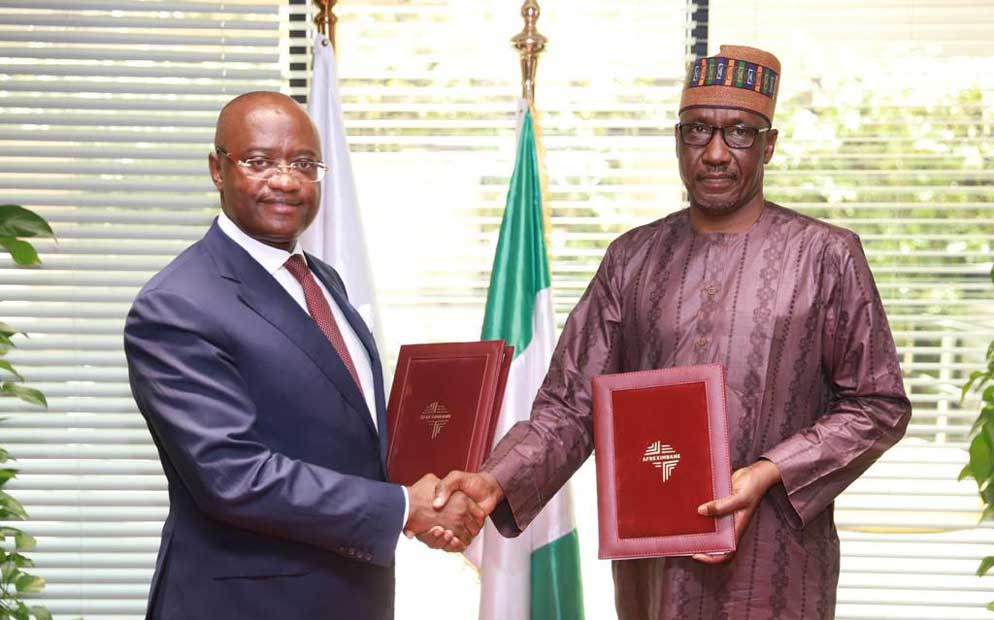

The NNPC Ltd. and Afreximbank Wednesday jointly signed a commitment letter and Termsheet for an emergency $3 billion crude oil repayment loan.

The signing, which took place at the bank’s headquarters in Cairo, Egypt, will provide some immediate disbursement that will enable the NNPC Ltd. to support the Federal Government in its ongoing fiscal and monetary policy reforms aimed at stabilising the exchange rate market.

Also read: Reps probe alleged N20 billion diversion by NNPCL officials

In an explainer posted by the Senior Special Assistant to the President on New Media, Otega Ogra and the NNPCL on her social media handle, the NNPCL said the loan will assist in settling taxes and royalties in advance.

The company noted that the loan will also equip the Federal Government with the necessary dollar liquidity to stabilise the Naira, with limited risk.

Addressing speculations regarding the terms of the loan, the NNPCL noted that it is not a crude-for-refined products swap but an upfront cash loan against proceeds from a limited amount of future crude oil production.

“The exposure for NNPC Ltd. is very limited, covering just a fraction of their entitlements. Additionally, there are no sovereign guarantees tied to this loan.

“The loan will be repaid against a fraction of proceeds from future crude oil production. It’s a strategic move that ensures a balance between our current economic needs and future production capabilities,” The NNPCL explained.

Additionally the NNPCL noted that the long-term effect of the loan will impact fuel prices positively if the Naira appreciates in value.

“A strengthened Naira as a result of this initiative will lead to a reduction in fuel costs. This means that if the Naira appreciates in value, the cost of fuel will drop and further increases will be halted.

“A stronger Naira will result in lower prices from the current level, making subsidies unnecessary. The deregulation policy remains unchanged.”

The funds are expected to be released in stages or tranches based on the specific needs and requirements of the Federal Government.

Dubious tactic to make naira appreciate in parallel market — Atiku’s aide

The Special Assistant on Public Communication to former Vice President, Atiku Abubakar, Mr. Phrank Shaibu reacting to the announcement of the loan facility described it as “a mere banana peel,” a ruse to force the naira to appreciate on the parallel market.

In a statement, in Abuja, on Wednesday, he said the move was cosmetic and unimaginative and had “once again exposed President Bola Tinubu as a lilliputian economist that lacked ideas on how to rescue the economy he had pushed to the edge with unviable policies.”

He maintained that monetary policy was not the job of the NNPCL but the Central Bank of Nigeria, wondering why the NNPCL, which claimed to be a profit-making organisation, would go ahead to take a loan for the primary purpose of stabilising the naira.

Shaibu noted that oil production had dropped on Tinubu’s watch due to continuous oil theft.

He pointed out that instead of boosting forex liquidity by increasing production and exports, Tinubu decided to take the Jejune path of obtaining foreign loans, an inglorious road that his predecessor had travelled.

Shaibu said, “For many years, Tinubu claimed that he built the economy of Lagos from scratch. Now, he has been exposed as a charlatan. His administration detained Emefiele and vilified him for taking FX loans from JP Morgan and Goldman Sachs running into $7.5billion, which was used in defending the naira.

“Now, Tinubu’s administration claims to have done the same thing by forcing the NNPCL to take a loan of $3bn to defend the naira. We, however, have it on good authority that this is all a ruse to force the naira to appreciate at the parallel market, an action that will further affect the government’s credibility.

“The NNPCL has failed to shed the toga of an ordinary government agency. No wonder it has refused to become a public limited liability company, as stated in the Petroleum Industry Act.

“The NNPCL boss, Mele Kyari, who is also desperate to retain his job, has allowed himself to become a willing political tool just like Emefiele. If the NNPCL was a publicly listed oil firm like Aramco and Mobil, would it obtain a loan in order to ‘defend the naira’?”

He further stated that Tinubu lacked a clear economic blueprint, hence his constant failures. He argued that Tinubu’s policy flip-flops had already begun affecting Nigerian bonds, as reported by Bloomberg.

De-institutionalise parallel market to stabilise FX — NECA

The Nigeria Employers’ Consultative Association, (NECA) has urged the Federal Government to de-institutionalise parallel market to reduce the pressure of Foreign Exchange(Fx) and other economic challenges associated with it.

This was made known in a statement titled Ramping –up FOREX Revenue, Crude Production and Non-Oil Exports-Urgent Imperative for Economic Recovery.

The Director-General of the body, Adewale -Smatt Oyerinde, said, “The unification of exchange rate policy was supposed to bring into convergence the exchange rates at the official FOREX market and the parallel market windows.

At the beginning of implementation, the policy appeared to have gained traction but has now progressively become undesirable. While the official exchange rate stood at about N781.64/US, the parallel market around N900/US$ as noted by the Central Bank of Nigeria (CBN), the differential of which shows a premium of about 21 percent between the two windows.

“As observed by the CBN, illegal remittances through inappropriate channels and unlawful selling of Dollars by commercial banks are the core reasons the Naira value has continued to degenerate. While agreeing with the apex bank, we want to add that the continuous existence of the parallel market, particularly in open places is more than culpable for the ugly development.

‘‘We believe that as long as the ‘black market’ with the institutionalized name, ‘parallel market’ persists, unruly banks in the country will continue to round-trip, notwithstanding the implication on the economy.

“The persistent wrong channeling and mismanagement of FOREX on organized businesses has become agonising. Business working capital, production, capacity utilization, investment, sales, etc., have contracted significantly, while firms are forced to downsize. The grey trajectory portends tragedy for the economy if not quickly addressed.

“Consequently, a more stringent action that will significantly reduce the influence of economic saboteurs in the FOREX value chain must be implemented. We believe that if the Parallel market is not legal, then it is illegal and should be treated as such.

“In order to reduce the pressure of FOREX and other economic challenges associated with it, we urge the Government, as a matter of urgency, to ramp up the production of crude oil to at least the 1.8 million barrel per day OPEC quota for the country; pursue and eliminate crude oil theft; resume domestic refining to save FOREX for other productive uses; and be fiscally disciplined in terms of Dollar dealings.

“These measures will no doubt, avail more FOREX to CBN for onward intervention in the official FOREX market, which will enable businesses to source FOREX to sustain business activities.”