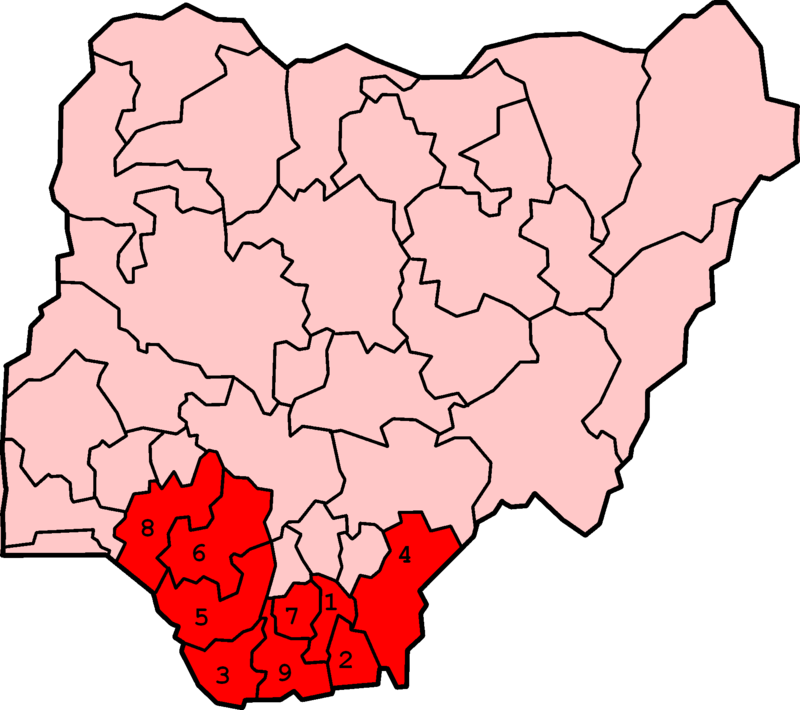

Akwa Ibom State tops list of three Nigerian states in the South South region- Bayelsa, Delta and Rivers- to receive N2.42 trillion as recalculated oil derivation funds, Federal High Court had ordered.

Consequently, Policy Alert has warned the state governments in the region to resist the temptation of using the recent court judgments ordering the federal government to pay the oil producing states their share of recalculated oil derivation revenue as guarantee for new loans.

Recall that Federal High Court had, over the last few months, ordered the Federal Government to pay $2.258 billion to Akwa Ibom State, $1.638 billion to the Delta State, $1.114 billion to Rivers State, and $951 million to Bayelsa State.

The money as share of recalculated oil derivation revenue in line with Section 16(1) of the Deep Offshore and Inland Basin Production Sharing Contract (PSC) Act obligates the federal government to adjust the share of the Federation in the additional revenue if the price of crude oil at any time exceeds $20 per barrel.

A statement released Friday, Tijah Bolton-Akpan, Executive Director of the Alert, a civil society organisation promoting economic and ecological justice in the Niger Delta, warned that any attempt by state governors to use the judgment as a source for immediate funding through loans would undermine accountability.

According to the director, it would further compound the debt crisis facing states in the region, and cancel out any positive gains the sudden injection of funds could have had on fiscal space in the states.

Bolton-Akpan said: “The four states stand to receive a sudden inflow of $5.9 billion (equivalent to N2.42 Trillion).

”This presents a rare opportunity to ensure that receipts from valuable, but exhaustible oil and gas resources, translate into higher living standards for these states and especially for the communities that bear the brunt of oil and gas extraction, both for the current generation and also for the future.

”While we call on the federal government to expedite action on the payments in line with the orders of the Court, it is necessary to sound a cautionary note on the utilization of the expected funds.

“Firstly, we must urge the state governments to resist the temptation to use the court judgment as backing to obtain credit advances from banks, especially because most of the states are already neck deep in debt.

”Data from the Debt Management Office and Policy Alert’s analysis shows that of March 2021, the eight oil producing states of the Niger Delta currently account for more than a quarter of the total sub-national debt stock and 30 percent of the domestic debt stock.

”Specifically, the four states expecting these payments account for more than 16 percent of the total sub-national debt stock and about 21 percent of the domestic debt stock. Two of these four states, Rivers and Akwa Ibom, have the highest per capita sub-national debt in the country.

”With the current debt outlook, it would be very risky and imprudent if the judgment is converted to an instrument for hastily securing loan advances by the states, rather than wait for the payment to come in agreed tranches from Federal government.

It would also be in violation of Section 45(2) of the Fiscal Responsibility Act 2007 as well as the states’ Fiscal Responsibility Laws which specify conditions for borrowing by any government.”

The statement added: “Sudden and massive exposure to oil derivation payments often come with peculiar downsides. First is the tendency to treat the inflows as a windfall, which could manifest in weak domestic revenue mobilization, sudden rush to invest in expensive trophy projects and even corrupt misuse of the funds for succession politics as the election year 2023 approaches.

”Also, due to the quantum of derivation flows as a proportion of total revenues, these sub-national economies could become unduly exposed to fiscal shocks associated with oil price volatility.

”There is also the risk that the sudden receipts could falsely minimize the urgency for oil-rich states to diversify their revenue sources in view of the low-carbon energy transition.”

The statement, therefore, charged citizens of the affected states to lead the conversation on how best the refund should be spent, stressing that citizen apathy toward this important development would leave gaps that may boomerang on the fiscal space in the future.